那些伟大的构想 Those Big Ideas

——了解Paypal创始人的奇妙人生

发音:英美发音

语速:175词/分钟

使用方法:泛听+复述

出生于德国并获得了斯坦福大学博士学位的皮特·泰尔,也许是一个让你觉得陌生的名字,但是说到Paypal、Facebook这些名号,你恐怕就颇感兴趣了。从创立国际网络支付系统PayPal,到成为全世界最著名的社交网络服务网站Facebook的投资人,人们惊讶地发现,这位“自由市场”的天才,脑子里充满了各种奇思妙想,总能高招百出地为人们带来创意生活。

还等什么呢?赶快来听听看皮特·泰尔的那些伟大构想吧。

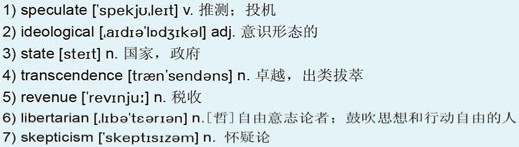

Mike William: Hello. My guest today has made a great fortune creating and investing in some of the biggest names on the internet including the on-line payment system PayPal. He also lost fortune, too, 1)speculating against America's economic recovery. Still, he has enough money left to pursue his interests, among them making more money, saving Western civilization through technology, and helping people establish communities, real and virtual, that are beyond the reach of national governments. Peter Thiel, welcome to the interview. 迈克·威廉:大家好。今天我们请来的这位嘉宾曾经在互联网上创立并投资打造了一些响当当的名号,包括国际网络支付系统PayPal,他因而身家暴涨。但他也曾错判美国经济复苏的时间而投机失利,亏了不少钱。不过,他仍有足够的资本剩下来投入自己的兴趣所在,这包括去赚更多的钱,以科技挽救西方文明,帮助人们建立连国家政府都无法触及的真实社群及虚拟社区。皮特•泰尔,欢迎来到我们的节目。

迈克·威廉:大家好。今天我们请来的这位嘉宾曾经在互联网上创立并投资打造了一些响当当的名号,包括国际网络支付系统PayPal,他因而身家暴涨。但他也曾错判美国经济复苏的时间而投机失利,亏了不少钱。不过,他仍有足够的资本剩下来投入自己的兴趣所在,这包括去赚更多的钱,以科技挽救西方文明,帮助人们建立连国家政府都无法触及的真实社群及虚拟社区。皮特•泰尔,欢迎来到我们的节目。

Peter Thiel: Thank you for having me.

皮特·泰尔:谢谢你请我来作客。

Mike: Let's talk about your activities, well, during your time at Stanford, but particularly afterwards; the creation of PayPal, this on-line payment company that you co-founded and led with a couple of other partners. You've said that it wasn't simply a business idea, that it had a…an 2)ideological foundation to it, to liberate commerce on the internet from the 3)state, to create a new world currency. Hand on heart, was that really a major factor or did you just want to make some big bucks?

迈克:我们来谈谈你的一些往迹吧,在斯坦福大学念书时,还有尤其是毕业后的足迹。你跟几个合伙人一起创办了PayPal这样一家网络支付公司。你讲过那不仅仅是个商业构思,里面还包含着一种意识形态底蕴,要把网络商务从政府手上释放出来,要创造通行全球的全新货币。老实说,这真是你主要考虑的因素吗?抑或只是找个借口赚大钱而已?

Peter: Well, I…I think all successful companies have some sense of 4)transcendence, some sense of purpose that's beyond just making money, and I think…I think sort of Google's model was to, you know, organize the world's information. Facebook is to help people around the world share things with one another and help people connect with one another, and so I think there's always some sort of sense of transcendence like this that you have in…in great companies. And when you're starting a company, it can never be just about making money because there's no company, there's no money, there are no 5)revenues and certainly no profits. PayPal was started in December of 1998. We launched the first product in October '99. It grew pretty quickly, but there were…it was a massive money-losing operation for quite awhile: it burned through about a hundred eighty million dollars before getting to break even in September 2001. And certainly a lot of the people were motivated by trying to create a new form of money or something like that, so I think it was…I think you want to always have something like that. And when I look at businesses that people are starting, that I try to get involved with as a board member or investor these days, I always am looking for things where there is at least some…some big idea. You may not get to the big idea, but you're much more likely to get to at least a small idea if you start with a big one than if you start with a small one or none at all.

皮特:我觉得所有成功的公司都多多少少有份超越感,不单纯以盈利为目的的这么一份使命感。我觉得,谷歌的模式就有点像是在整理全球的资讯。Facebook就是让世界各地的人们相互分享相互沟通。所以我相信,优秀的商企都在某程度上具备这样一份超越感。在你创建公司的时候,光想着赚钱是不行的,因为那时候公司还不成公司,也没资金,没收入,更没盈利可言。PayPal是在1998年12月开始筹建的。我们在1999年10月推出了第一个产品,之后公司迅速壮大,但是有很长一段时间我们都是巨额亏损的:直到2001年9月我们才开始归本盈利,之前总共烧钱烧了一亿八千万美元。同时,对于创造新型货币这类东西,肯定会有很多人支持,所以,我觉得,总该有那样的一种理念在背后吧。现在,每当我获邀担当某公司企业的董事或者投资伙伴的时候,我都会去看他们有没有什么伟大构想作支撑。这些宏愿也许最终无法完全达成,毕竟“取法乎上,只得其中”,如果你能怀着伟愿出发,至少能略有所成,总比一开始就着眼蝇头小利或毫无信念要好。

Mike: What appealed to you about the idea, the big idea that you say you look for in companies. What was the big idea behind Facebook?

迈克:你说自己会着眼寻求的公司“伟大构想”,究竟有什么那么吸引你呢?Facebook背后有什么伟大构想呢?

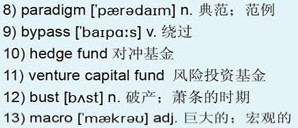

Peter: Well, one of my friends from my undergraduate days at Stanford, Reid Hoffman, had been thinking about social networking for probably a decade. He ended up starting Linked-in, which was the business networking site, in 2003, so Reid and I had been looking at this social networking idea quite a bit. As a 6)Libertarian, I had some ideological 7)skepticism about it because I thought that, you know, it should all be about individuals, and then Reid's argument was always, “Well, it's all about society and people exist in society, not as individuals.” And I think Face…Facebook is somewhere, if you want to describe it ideologically, somewhere in between a Libertarian and a centralized view of the world, and so it's somehow very far outside the 8)paradigms of what you might have described as 20th Century political theory, where it was decentralized right versus centralized left.

Peter: Well, one of my friends from my undergraduate days at Stanford, Reid Hoffman, had been thinking about social networking for probably a decade. He ended up starting Linked-in, which was the business networking site, in 2003, so Reid and I had been looking at this social networking idea quite a bit. As a 6)Libertarian, I had some ideological 7)skepticism about it because I thought that, you know, it should all be about individuals, and then Reid's argument was always, “Well, it's all about society and people exist in society, not as individuals.” And I think Face…Facebook is somewhere, if you want to describe it ideologically, somewhere in between a Libertarian and a centralized view of the world, and so it's somehow very far outside the 8)paradigms of what you might have described as 20th Century political theory, where it was decentralized right versus centralized left.

皮特:我在斯坦福读本科时认识的一个朋友雷德·霍夫曼想建社交网站也大概想了十年,最后在2003年创建了商务交际网站Linked-in。雷德和我一直对社交网络的理念有点研究。作为一名自由主义者,我对社交网站的意识形态取向总有点保留,我觉得一切应该以个人为导向,但雷德却总是认为“应该以社区社会为导向,人们存在于社群里,并非单独的个体” 。 我想,论及意识形态取向,Facebook就介乎于自由主义和集权思想之间,远远不同于二十世纪政治理论里的一些范例,以前大家只会讲民主右派与专权左派的两极倾向。

Mike: You seem to enjoy technologies that help people 9)bypass traditional ways of doing things: shopping on line, meeting on line. Is that fair? You want them to do things in a different way?

迈克:你好像挺喜欢那些让人们绕过传统办事模式的科技手段,比如说网购、网聚之类的。我没说错吧?你想让大家换个方式行事?

Peter: Well, I…I believe technology is fundamentally about trying to improve things, make the world better. Things that are better I would say are things where you can do more with less.

皮特:嗯,我相信,从根本来说,科技为的是改善周遭一切,让世界变得更美好。所谓变得更好,我觉得就是你能投入更少而获得更多。

Mike: Let's move on. You established a 10)hedge fund after you'd…after you'd sold PayPal. Why? Well to make money, of course, but anything else? What was the big idea?

迈克:我们聊个别的话题吧。你在出售PayPal的股份之后建立了一个对冲基金。为什么会有此举动呢?当然是为赚钱,那不用说了,但是还有其他原因吗?背后有什么宏远构想吗?

Peter: Well, I continued to run both the hedge fund and a 11)venture capital fund, and what both have in common is thinking about the future of the world; what is, you know, happening both on the technology side and then on the larger scale economic side. I have found that these questions about the future are very important. They were critical in the 90s and earlier 2000s decade with the tech boom and 12)bust cycle, which was in, on the one hand a micro-story about technologies and on the other hand a 13)macro-story about economics. I think both of these things are…are very important to think about.

皮特:我之后去管理一个对冲基金还有一个风险投资基金,两者的共通之处是都得对全球的未来作出思考,要考虑到科技以及宏观经济方面的态势。我发现,针对这些问题来考虑未来的发展是非常重要的。在上世纪90年代以及本世纪初的十年间,这些更是关键问题,科网业在这期间经历了从鼎盛到爆破的完整商业周期,这一方面反映了科技业发展的微观世界,另一方面也是我们经济发展的宏观景象。这些都是值得我们思考的重要方面。

Mike: Peter Thiel, thanks for talking to us here on the interview.

迈克:谢谢皮特·泰尔今天来到这里接受我们的访问。

Peter: Awesome being on. Thanks.

皮特:很高兴来到这里。谢谢。