在黑天鹅被发现之前,生活在十七世纪欧洲的人们都相信一件事——所有的天鹅都是白色的。因为当时所能见到的天鹅的确都是白色的,所以根据经验主义,那简直就是一个真理,或者至少可以算是一个公理吧。那么,见到黑色天鹅的几率是多少呢?根本无法计算,也没有人想过要计算。直到1697年,探险家在澳大利亚发现了黑天鹅,人们才知道以前的结论是片面的——并非所有的天鹅都是白色的。这一事件证明了我们的认知是多么地具有局限性——虽然你是在观察了几百万只天鹅之后才得出了“所有的天鹅都是白色的”结论,但只需要另一个发现就能将它彻底推翻。

在黑天鹅被发现之前,生活在十七世纪欧洲的人们都相信一件事——所有的天鹅都是白色的。因为当时所能见到的天鹅的确都是白色的,所以根据经验主义,那简直就是一个真理,或者至少可以算是一个公理吧。那么,见到黑色天鹅的几率是多少呢?根本无法计算,也没有人想过要计算。直到1697年,探险家在澳大利亚发现了黑天鹅,人们才知道以前的结论是片面的——并非所有的天鹅都是白色的。这一事件证明了我们的认知是多么地具有局限性——虽然你是在观察了几百万只天鹅之后才得出了“所有的天鹅都是白色的”结论,但只需要另一个发现就能将它彻底推翻。

黑天鹅事件是不可预测的重大事件。它罕有发生,但一旦发生,就具有很大的影响力。

美式发音 适合模仿

Excerpt from Chapter Four

How to Learn from the Turkey 如何从火鸡的经历中学习(节选)

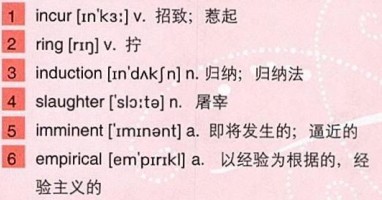

Consider a turkey that is fed every day. Every single feeding will firm up the bird’s belief that it is the general rule of life to be fed every day by friendly members of the human race, looking out for its best interests, as a politician would say. On the afternoon of the Wednesday before Thanksgiving, something unexpected will happen to the turkey. It will 1)incur a revision of belief.

The rest of this chapter will outline the Black Swan Problem in its original form: how can we know the future, given knowledge of the past? Or, more generally, how can we figure out properties of the infinite unknown, based on the finite known?

Think of the feeding again. What can a turkey learn about what is in store for it tomorrow from the events of yesterday? A lot, perhaps, but certainly a little less than it thinks. And it is just that little less that may make all the difference.

The Turkey Problem can be generalized to any situation where the same hand that feeds you can be the one that 2)rings your neck.

Let’s go one step further and consider 3)induction’s most worrisome aspect: learning backward.

Consider that the turkey’s experience may have, rather than no value, a negative value. It learned from observation, as we are all advised to do. (Hey, after all, this is what is believed to be the scientific method.) Its confidence increased as the number of friendly feedings grew, and it felt increasingly safe, even though the 4)slaughter was more and more 5)imminent. Consider that the feeling of safety reached its maximum when the risk was at the highest. But the problem is even more general than that. It strikes at the nature of 6)empirical knowledge itself. Something has worked in the past until…well, it unexpectedly no longer does. And what we have learned from the past turns out to be, at best, 7)irrelevant or false; at worst, 8)viciously misleading.

想象一下一只每天有人喂食的火鸡。每次喂食都使它更加相信生命的一般法则就是每天得到“为它的最大利益着想”(政客们都这么说)的友善人类的喂食。感恩节前的星期三下午,一件意料之外的事情将发生在它身上。这件事将导致一次信念的转变。

想象一下一只每天有人喂食的火鸡。每次喂食都使它更加相信生命的一般法则就是每天得到“为它的最大利益着想”(政客们都这么说)的友善人类的喂食。感恩节前的星期三下午,一件意料之外的事情将发生在它身上。这件事将导致一次信念的转变。

本章余下的部分将以原本的形式概括“黑天鹅问题”:如何从过去的知识中预知未来,或更笼统地说,如何从有限的已知推测无限的未知?

再想想喂食的例子:一只火鸡如何通过对昨天情况的观察知道明天给它喂食的量有多少?可能很多,但肯定比想象的少一点,但就是那“少一点”使事情有完全不同的结果。

“火鸡问题”可以把“喂你的手也可能是拧断你脖子的那只手”的情况一般化,运用到所有事情上。

我们再进一步探讨归纳法最令人不安的一面:反向学习。

假设火鸡的经验可能不是毫无价值,而是有一个负价值。正如我们都被一向教导的那样,它从观察中学习(嗨,毕竟这是人们相信的科学方法)。随着友好喂食次数的增加,它的信心也增加了,虽然被宰杀的危险越来越近,它却感到越来越安全。想一想,当危险最大时安全感竟达到最大值!但真正的问题比这更具有普遍性,它直指经验知识本身。某种东西在过去一直起作用,直到它出乎意料地不再起作用,而实际上,我们过去获得的知识顶多只不过是无关痛痒或虚假的知识,甚至是危险的误导。

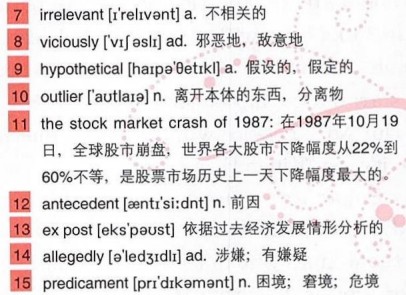

Take, for example, the proto-typical case of The Problem of Induction as encountered in real life. You observe a 9)hypothetical variable for one thousand days. It could be anything, with a few mild transformations: book sales, blood pressure, crimes, your personal income, a given stock, the interest on a loan, or Sunday attendance at a specific Greek Orthodox Church. You subsequently derive, solely from past data, a few conclusions concerning the properties of the pattern, with projections for the next thousand, even five thousand days. On the one thousand and first day, boom, a big change takes place that is completely unprepared for by the past.

Note that after the event you start predicting the possibility of other 10)outliers happening locally, that is in the process you were just surprised by, but not elsewhere. After 11)the stock market crash of 1987, half of America’s traders braced for another one every October, not taking into account that there was no 12)antecedent for the first one. We worry too late—“13)ex post”.Mistaking a naive observation of the past as something definitive or representative of the future is the one and only cause of our inability to understand the “Black Swan.”

Those who believe in the unconditional benefits of past experience should consider this pearl of wisdom, 14)allegedly voiced by a famous ship’s captain.

“But in all my experience I have never been in any accident of any sort worth speaking about. I have seen but one vessel in distress in all my years at sea. I never saw a wreck and never have been wrecked, nor was I ever in any 15)predicament that threatened to end in disaster of any sort.”

——E. J. Smith, 1907,

Captain, RMS Titanic

Captain Smith’s ship sank in 1912 in what became the most talked-about shipwreck in history. Statements like those of Captain Smith are so common that it isn’t even funny.

我们以在现实生活中碰到的典型归纳问题为例。你对一个假设变量观察了1000天。它可以是变化不大的任何事物:图书销量、血压、犯罪、你的个人收入、某只股票、贷款利率或某个希腊东正教教堂礼拜日的出席人数。然后你仅仅从过去的数据中得出关于其变化的趋势特征,预测未来1000天,甚至5000天的趋势。在第1001天——砰!一个过去毫无征兆巨大的变化出现了!

注意,这一事件过后,你会开始局部地预测再出现意外的可能性,也就是说仅仅在你遭遇意外事件的这个范围内考虑意外事件,而不在别的范围里考虑。1987年的股市崩盘后,美国有一半的股票交易员在每年的10月都为类似的行情做好准备,但他们没有想到在第一次股市崩盘之前是没有先例的。我们担心得太晚了,而且都是马后炮。错误地把对过去一次幼稚的观察当成某种确定的东西或者代表未来的标识,是我们无法把握黑天鹅现象的惟一原因。

那些无条件相信过去经验的人应该想一想一位著名的船长就这一方面的至理名言:  “根据我所有的经验,我没有遇到任何值得一提的事故。在整个海上生涯中,我只见过一次遇险的船只。我从未见过失事船只,从未处于失事的危险中,也从未陷入任何有可能演化为灾难的险境。”

“根据我所有的经验,我没有遇到任何值得一提的事故。在整个海上生涯中,我只见过一次遇险的船只。我从未见过失事船只,从未处于失事的危险中,也从未陷入任何有可能演化为灾难的险境。”

——E·J·史密斯,泰坦尼克号船长,1907年

史密斯船长的船于1912年沉没,成为历史上被提起次数最多的沉船事故。像史密斯船长这样的话我们已经听过多次,早就不新鲜了。

翻译:旭文

作者简介

Nassim Nicholas Taleb是当前最令人敬畏的风险管理理论学者。他毕业于芝加哥大学,获得经济学博士学位。他曾在纽约和伦敦交易多种衍生性金融产品,也曾在芝加哥当过营业厅的独立交易员,并创办了一家资本公司。从2004年开始,他成为了纽约大学库朗数学研究所的研究员。他的上一部作品《被随意性愚弄》(Fooled by Randomness)被翻译成十九种语言出版,是当年的最畅销书之一。他的第二部畅销作品《黑天鹅》的销量高达150万本。

Nassim Nicholas Taleb是当前最令人敬畏的风险管理理论学者。他毕业于芝加哥大学,获得经济学博士学位。他曾在纽约和伦敦交易多种衍生性金融产品,也曾在芝加哥当过营业厅的独立交易员,并创办了一家资本公司。从2004年开始,他成为了纽约大学库朗数学研究所的研究员。他的上一部作品《被随意性愚弄》(Fooled by Randomness)被翻译成十九种语言出版,是当年的最畅销书之一。他的第二部畅销作品《黑天鹅》的销量高达150万本。