英式发音 适合精读

Harvard captures the imagination like few other institutions. World leaders from President Barack Obama to U.N. Secretary General Ban Ki-Moon are Harvard graduates. Business titans like Jamie Dimon, chief executive of JPMorgan Chase, A.G. Lafley of Procter & Gamble and Lloyd Blankfein of Goldman Sachs are too. I’ve found the academic training I received at graduate school there invaluable—but I learned even more outside the classroom than in it. Here are three key lessons that helped my career that Harvard didn’t teach me in the classroom.  哈佛像其他几所知名大学一样让人想入非非。美国总统巴拉克·奥巴马和联合国秘书长潘基文这样的世界知名领袖都毕业于哈佛。商业巨头如JP摩根大通的首席执行官杰米·戴蒙、保洁公司总裁A·G·雷富礼和高盛集团董事长兼首席执行官劳埃德·布兰克费恩也都出身哈佛。我发现自己在哈佛研究生院中接受的课堂训练无疑是非常宝贵的——但我在课堂外的实践活动中收获更多。以下是对我的事业大有裨益但在哈佛课堂中并没教授的重要的三课。

哈佛像其他几所知名大学一样让人想入非非。美国总统巴拉克·奥巴马和联合国秘书长潘基文这样的世界知名领袖都毕业于哈佛。商业巨头如JP摩根大通的首席执行官杰米·戴蒙、保洁公司总裁A·G·雷富礼和高盛集团董事长兼首席执行官劳埃德·布兰克费恩也都出身哈佛。我发现自己在哈佛研究生院中接受的课堂训练无疑是非常宝贵的——但我在课堂外的实践活动中收获更多。以下是对我的事业大有裨益但在哈佛课堂中并没教授的重要的三课。

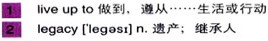

I learned the first lesson from my own students. I was a teaching fellow at the time, educating them on China’s modern history and political system. I probably learned more from them than they from me. Every day students would come to my office overlooking Harvard Yard, and we’d usually end up talking about more than just China. We’d discuss their hopes and, more often than not, their fears. They were afraid of not keeping up with their peers and not 1)living up to their parents’ expectations.

第一课是我的学生们给我上的。那时我在哈佛当老师,给学生讲授中国现代史和政治制度。可能我从他们身上学到的知识要比他们从我这里学到的还要多。每天,学生们都会来到我那间能够俯瞰哈佛园的办公室,我们通常探讨的话题并不仅仅局限于中国。我们会谈论他们的梦想,但谈论更多的是他们的担忧。他们都担心自己有朝一日落后于同辈和辜负父母的期望。

They felt this way pretty much across the board. Rich kids and 2)legacies thought they’d gotten there because of their families; minority students worried they were there because of their skin color; brains from humble backgrounds worried they weren’t rich enough to be there. But they themselves couldn’t easily 3)gauge how their work measured up against others’, and this fed their insecurities.

所有的学生都有这方面的担忧。富家子弟和名人之后认为他们入读哈佛是因为他们显赫的家世;少数族裔学生则担心是因为自己的肤色;来自下层的学生担心自己的家底不够殷实而无法立足于此。但他们自己难以发现自己的过人优势,这加深了他们的不安。

The most brilliant of them, though, didn’t let their fears stop them from thriving. They did the opposite. They had plenty of fear in them, but rather than let it dominate them they used it to motivate them to prove those fears wrong. They worked harder to confirm for themselves that they really did belong. Often the most insecure of them were also the most brilliant.

然而,他们中最聪明的人却不会让自己的担忧阻挡其获得成功。恰恰相反。虽然他们也很害怕,但与其让恐惧支配自己,他们选择将其转化为动力,激励自己来证明那些恐惧是错误的。他们更加努力学习以印证自己属于哈佛。很多时候,那些最不安的人也恰恰是最杰出的人才。

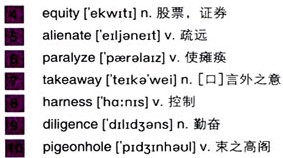

Businessmen need to conquer their fears too. They need to know how to control their worries and see opportunity where others don’t. Too many businessmen have been letting their fear rather than rational thinking determine their decision-making ever since Lehman Brothers collapsed, and too many investors have been making hasty, panicky decisions. Many 4)equity investors sold all their holdings out of fear and missed the bull market of 2009. Many companies 5)alienated and hurt their workforces by cutting too much.

生意人也需要克服自己的恐惧。他们得知道如何抑制自己的忧虑并发现其他人没有看到的机会。自雷曼兄弟宣告破产后,被焦虑情绪而非理性思维驱动作出错误决断的例子屡见不鲜:有太多的投资者都草率、慌张地作出决定。由于恐惧,许多证券投资者抛售了自己的所有股份,以致错过了2009年的牛市。许多公司大幅度削减员工待遇,结果使劳资关系疏远并使公司劳动力受损。

PepsiCo and Disney are two companies that didn’t let fear 6)paralyze them. They looked coolly around and found opportunities while others were too terrified to make big moves. They announced multibillion-dollar investments in China and other emerging markets in the depths of the financial crisis. Now that we are in the beginnings of a worldwide recovery, those investments are putting them ahead.

百事公司和迪斯尼这两家公司并没有被恐惧所奴役。在其他企业由于惊恐而缩手缩脚时,他们冷静地纵观全局并发现机会。即便在经济危机的低谷中,他们依然宣布对中国和其他新兴市场投资数十亿美元。现在我们才刚开始步入全球复苏的状态,而那些投资就让他们走在了经济的前沿。

The 7)takeaway: 8)Harness fear and use it for positive results, as my most brilliant students did and as the best businessmen do. You can make money in good and bad times if you keep your head on straight, as hedge fund investors like George Soros and John Paulson know.

言外之意:就像最具才华的学生和最出色的商人那样,要驾驭恐惧并将它转化为有利因素。如果你像玩转对冲基金的乔治·索罗斯和约翰·保尔森一样心无旁骛,无论时局好坏你都可以挣到钱。

The second thing I learned was to do my own due 9)diligence and not blindly trust so-called experts. In today’s world it is difficult to know when to trust even your financial advisers. You have to do your own due diligence, even with experts. Due diligence is hard work and costly, but you have no choice.

我学到的第二课是要认真做好自己的功课,而非盲目相信所谓的专家。当今世界,你甚至连什么时候去信任自己的财务顾问也很难知道。即使有专家帮助你,你也必须得自己做好功课。这样做很辛苦且代价巨大,但你别无选择。

Finally, I learned that young people need to take stepping-stone positions when they start their careers. Something like 70% of Harvard graduates start out in consulting or investment banking, not just for the money but because those jobs provide good training. If you narrow your focus too early, you risk being 10)pigeonholed. For that reason I am critical of specialized programs in subjects like financial engineering or e-commerce. You’re better off getting a more well-rounded degree.

最后,我认识到青年人在开创自己的事业时需要打下坚实的基础。大约70%的哈佛毕业生选择咨询行业和投资银行业作为起点,这样做并非只为了金钱而是因为那些工作能够提供良好的锻炼。如果你过早地限定自己的目标,你就有被束之高阁的危险。基于这个原因,我并不看好如金融工程学或电子商务这样的专业化培训课程。你最好能够获得一个更全面的学位。

Young people sometimes ask me what kinds of jobs they should take right out of college. My advice: Do something that won’t limit your opportunities as your career progresses. Don’t worry about money until you’re 30. Until then, find great mentors and make sure you do things that give you exposure to different industries—and, importantly, a little sales experience.

有时年轻人会问我在毕业后应该马上从事什么样的工作。我的建议是:从事那些随着事业发展而不会限制你机遇的工作。30岁前不要担心钱的问题。在此之前,找些良师益友,确保你从事的工作能够让你接触到不同的行业——不光如此,一些销售经验也是很重要的。

I learned all those things while I was at Harvard, but I didn’t learn them in the classroom.

我在哈佛时学到了这些,但并非在哈佛的课堂中。

作者简介

肖恩·雷恩(Shaun Rein)在哈佛大学取得硕士学位,主攻中国经济。Shaun是战略市场情报公司中国市场研究集团(China Market Research Group)的创始人和董事总经理。他也是美国《商业周刊》亚洲专栏的撰稿人,并且定期在《福布斯》领导者板块和首席市场运营官板块上发表文章。