语音:英式发音 适合讨论

语速:190词/分钟

关键词:money, children, basic understanding

There are tough economic times ahead, and the government thinks our youngsters should be better prepared. The message is simple—that money matters—and therefore lessons should begin as soon as children start school. The plans mean that primary school children will be taught how to save money and manage bank accounts. Older children, from 11 to 14, will learn about credit cards and loans, and 15 and 16 year-olds will be taught about debt and how it affects peoples’ lives.

There are tough economic times ahead, and the government thinks our youngsters should be better prepared. The message is simple—that money matters—and therefore lessons should begin as soon as children start school. The plans mean that primary school children will be taught how to save money and manage bank accounts. Older children, from 11 to 14, will learn about credit cards and loans, and 15 and 16 year-olds will be taught about debt and how it affects peoples’ lives.

Girl A: Not a lot of people my age know about it. They don’t know that much about all the loans and stuff, and they’ll go into that part of the work and they won’t know what to do.

Boy A: It’s good for the future, ’cause then you’ll know how to control your credit card and how you pay it.

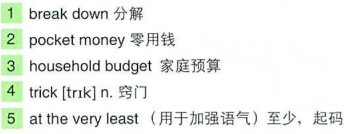

Girl B: They can 1)break it down and make it a lot easier for us to learn, like, not like the mums and dads do then.

Boy B: When you put money in, you get the money in your account, and when you take it out, you get to spend it.

The introduction of formal lessons about money has been welcomed by financial experts, so long as they’re based on real life.

Financial Journalist: I think schools are a great, great place to teach people the “technicals” behind how money works. Still, it’s gonna be “street smarts” once you get out there. Lots of kids have it. They know, with their mobile phones, how it works; they know, with their 2)pocket money, how to make it last. The problem is, as soon as they get older and they’re running a 3)household budget, they forget all those 4)tricks, because, suddenly, they’re too focused on other things, and we just need to teach the wider impact of how your pocket works to our children.

Exactly what pupils’ learn in their lessons will be decided later this year. 5)At the very least, the aim is that young people leave school with a basic understanding of how to manage their money sensibly.

艰难的经济时期还看不到尽头,政府认为年轻人更应该做好准备了。道理很简单——钱是很重要的,因此理财教育也应该从娃娃一踏进校门抓起。这项计划意味着小学生就要开始接受如何省钱和管理银行账户方面的教育。年龄再大一点的11至14岁的学生要学习信用卡和贷款的知识,而15至16岁的学生就要懂得债务及其对人们生活的影响。

女学生甲:像我这么大的孩子,没多少人懂这方面的知识。他们不太懂贷款什么的,他们以后会接触那方面的东西,但他们不懂得应该怎么做。

男学生甲:这对我们将来有好处,因为到时候你会知道如何运用自己的信用卡,如何用信用卡付费。

女学生乙:他们可以把复杂的内容细分,把它简单化,这样我们学习起来就容易得多,而不是像大人所处理的那么复杂。

男学生乙:当你把钱存进去时,你的银行账户就有钱了;而当你取出来时,你就会把钱给花掉。

将理财课程正式地引入课堂这一举措受到金融专家的欢迎,前提是它们源于现实生活。

金融记者:我想学校是教育人们金钱运作背后的“技巧”的理想之地。当然,当你走进社会的时候,理财依靠的主要还是“世俗智慧”。许多小孩子都具备这种智慧:手机让他们学会理财,他们也知道如何让零花钱变得耐花。但问题是,一旦他们长大掌管家庭开支的时候,他们就把这些基本技巧都忘了,因为他们突然间太专注于其他事情了。我们就是要把金钱运作的大原理传授给我们的孩子。

学生们具体会学习哪些内容,今年晚些时候就会见分晓。总之,这门课程的目标最起码就是要使学生毕业的时候能具备理性理财的基本知识。

Comments 观点参考

● Recent studies have found that the burden of debt, accentuated[强调] by the recession and high levels of unemployment, has created a new generation of “mummy’s boys[离不开父母、不能自立的人]”.

● While education cannot prevent debt, it can help to make people aware of their finances and possibly contribute to reducing the debt problem.

● Money management is something that has been overlooked for too long. Before now, people have just been expected to leave school and become financially independent with no guidance, in a society where credit is very readily available.

● The worry is that teachers think that personal finance is out of the comfort zone. As a result there is a danger that personal finance education will be marginalized[忽视,排斥].